Three principles and three proposals for International Tax after COVID-19

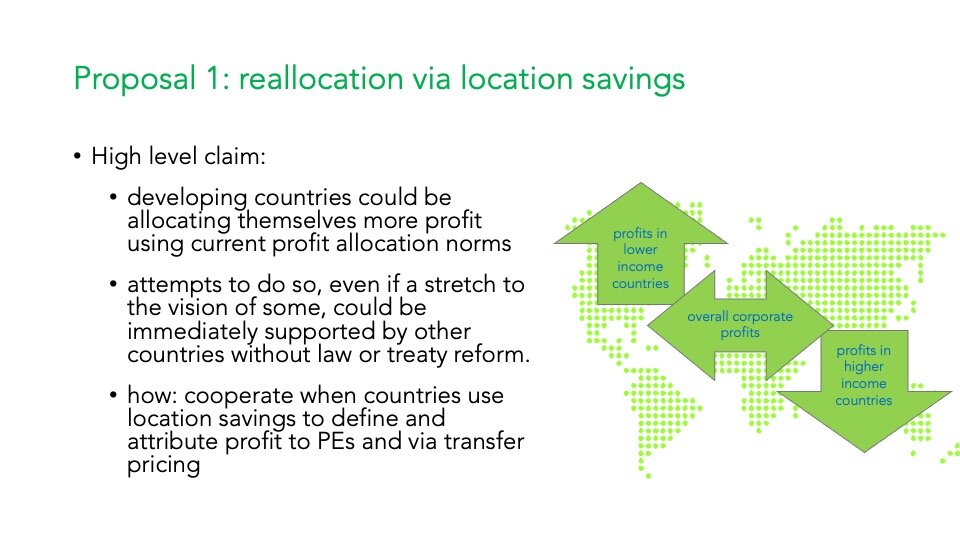

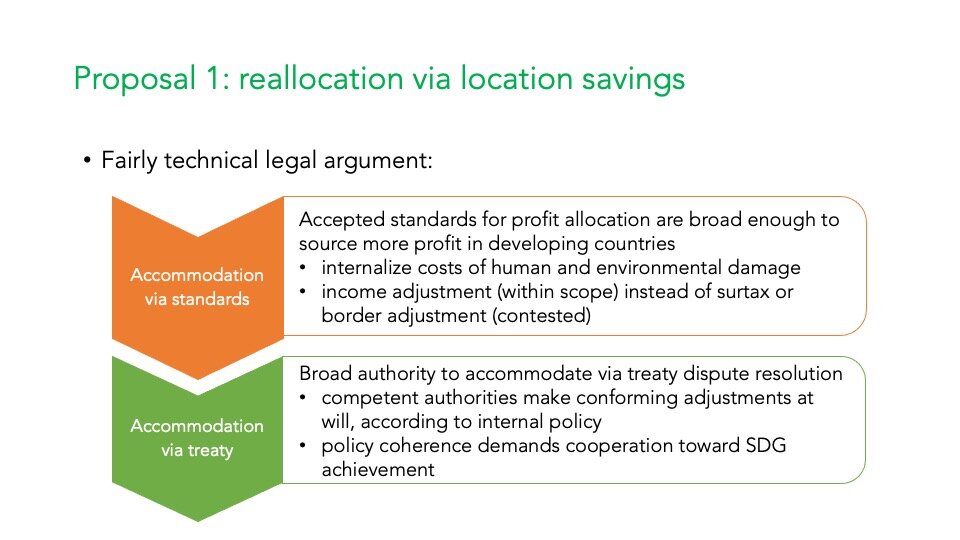

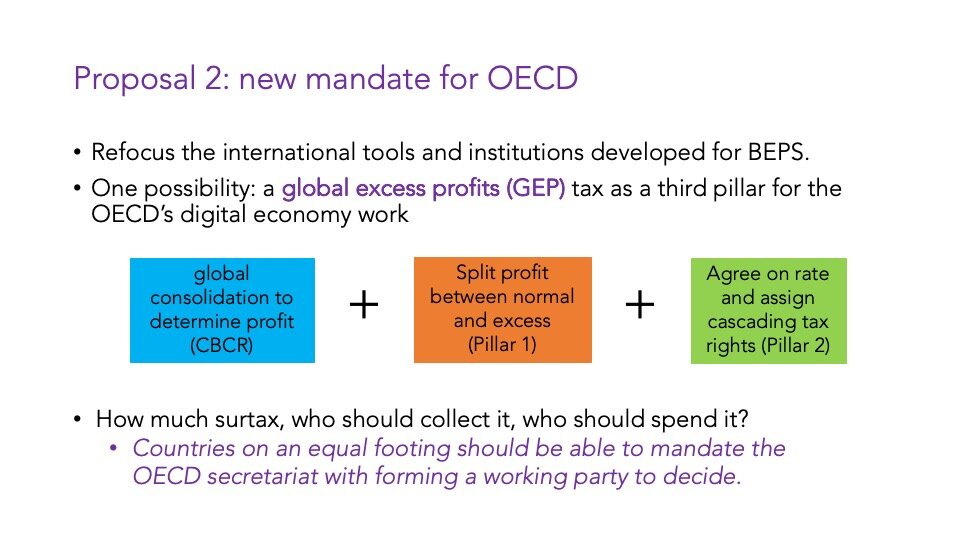

Tomorrow I will be presenting some thoughts at this virtual conference on Tax & Transparency in the Age of COVID-19. I’ll talk about what I think are the three principles for international taxation going forward, namely representativeness, transparency, and sustainability, and I’ll outline at a vary basic level two substantive proposals (sustainability-based location savings profit allocation and a global excess profits tax) and one procedural one (OECD working party on governance), as outlined in the presentation below.